Can I File a 1099 Without a Social Security Number?

Yes, it is possible to file a 1099 form without a social security number. While a social security number is the standard identifier for tax purposes in the United States, there are alternatives available for those who don’t possess one.Individual Taxpayer Identification Number (ITIN)

An ITIN is a tax processing number issued by the IRS for individuals who are not eligible for a social security number but need to fulfill their tax obligations. It’s used specifically for federal tax reporting and doesn’t confer the right to work in the U.S. Applying for an ITIN involves submitting the W-7 form along with the necessary documentation to the IRS.Employer Identification Number (EIN)

If you’re a freelancer or an independent contractor, you can use an EIN instead of a social security number on your 1099 forms. An EIN is typically assigned to businesses for tax purposes, but individuals who operate as sole proprietors can obtain an EIN. This option allows you to keep your personal and business finances separate.Foreign Tax Identification Number

Non-U.S. citizens who earn income in the U.S. can use their foreign tax identification number in place of a social security number. The tax treaty between the U.S. and their home country might also impact the tax rate and reporting requirements.

The Process of Filing a 1099 Without a Social Security Number

- Obtain the Appropriate Number: Before filing, ensure you have the correct tax identification number, whether it’s an ITIN, EIN, or foreign tax ID.

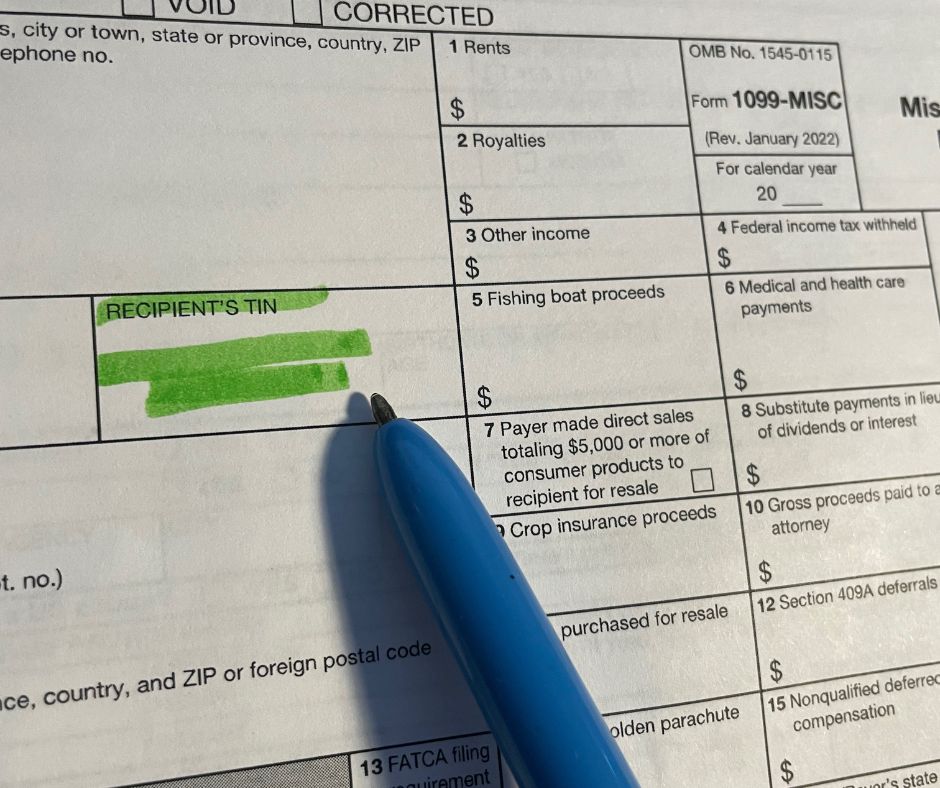

- Fill Out the 1099 Form: When completing the 1099-MISC form, enter your tax identification number in the designated field. This ensures that the IRS can associate the income with your tax account.

- Submit the Form to the Payer: If you’re a freelancer or contractor, provide your completed 1099 form to the client or payer. They will use this information to report the payments made to you.

- Keep Documentation: Maintain records of all communications, agreements, and tax documents related to your income. This documentation will be invaluable in case of any discrepancies or audits.

Using Databases to Obtain Social Security Numbers

For certain permissible purposes, such as completing a 1099 form, private investigators and individuals with access to authorized databases can find someone’s social security number. The ability to obtain a person’s social security number legally can be helpful in accurately reporting income and fulfilling tax obligations. It’s important to note that this process must strictly adhere to legal regulations and ethical guidelines. The information obtained should be used solely for its intended purpose and not for unauthorized or unlawful activities.Key Considerations When Filing Without a Social Security Number

- Tax Implications: Filing without a social security number might have implications for the taxes you owe and your eligibility for certain deductions. Consult a tax professional to ensure compliance.

- ITIN Renewal: If you choose to use an ITIN, remember that it needs to be renewed periodically. Failing to renew it could lead to processing delays.

- Work Authorization: While ITINs and EINs allow you to report income, they don’t grant work authorization. If you’re an international worker, make sure you have the necessary permits to work in the U.S.

- Tax Treaties: Non-U.S. citizens should explore tax treaties between their home country and the U.S. These treaties can impact the tax rates applied to their income.

FAQs

Can I file a 1099 without any tax identification number?

No, you need a tax identification number to file a 1099. It can be an ITIN, EIN, or foreign tax ID, depending on your situation.Is an ITIN only used for filing 1099 forms?

No, an ITIN is used for various tax-related purposes, including filing tax returns and claiming certain tax benefits.Can I apply for an EIN as a sole proprietor?

Yes, sole proprietors can apply for an EIN. It can help separate their business and personal finances.Will using an ITIN affect my immigration status?

Using an ITIN for tax purposes should not impact your immigration status. It’s intended solely for tax reporting.How often do I need to renew my ITIN?

ITINs need to be renewed if they haven’t been included on a tax return for three consecutive years.Are there exceptions to using a tax identification number?

Some individuals might be eligible for exceptions, but they are rare. It’s best to consult a tax professional to determine your eligibility.Conclusion:

Filing a 1099 without a social security number is indeed possible, thanks to alternatives like ITINs, EINs, and foreign tax IDs. By understanding the process and considerations associated with each option, you can fulfill your tax obligations accurately. Private investigators how to find someone’s social security number. Remember that tax laws can be complex, so seeking advice from tax experts or professionals is always a prudent step.

Can I File a 1099 Without a Social Security Number? Everything You Need to Know

When it comes to filing taxes and reporting income, the 1099 form is a crucial document. However, there might be situations where you find yourself

how to get someone else’s social security number

Searching for someone’s Social Security number will not be as hard as you may would imagine. There are many websites online that will help you

birthday lookup with social security number

Looking up someone’s Social Security number is just not as hard as you may would imagine. There are several websites online which can help you

i need to find someone’s social security number

Searching for someone’s Social Security number is just not as hard while you would imagine. There are lots of websites online that can help you

how to find someone’s last 4 ssn

Searching for someone’s Social Security number is not as hard while you would imagine. There are several websites online that will help you discover this

how to find someone’s social security number for free

Searching for someone’s Social Security number will not be as hard as you would imagine. There are numerous websites online that will help you see